Investing bank or investment in stocks?

Is the banking sector a good choice for value investing?

The banking sector is a good choice for value investing. Value investors look for stocks in which the market price does not fully reflect the business’s future cash flows. Often, they aggressively buy when others sell during times of bad news, poor performance or weak economic conditions. When most chase after stocks as they gallop higher, value investors sell.

alue investors are focused on the long term. Distress in the broader market or on an individual stock basis is what creates opportunities for value investors to buy at appealing discounts. The banking sector is quite sensitive to the economic cycle, so it is susceptible to extremes in price and valuations that attract value investors.

At the Bottom of the Economic Cycle

At the bottom of the cycle, fear runs rampant. This is the climate in which emotions drive price rather than fundamentals. Stocks in the banking sector are hit particularly hard because they have massive amounts of leverage and are intimately connected to the economy. Bank balance sheets typically operate at leverage in the double digits, so a small loss in asset value can turn the banks insolvent. This augments irrational extremes that are typically found at market lows.

When banks have made loans that need to be paid back, the risk of default is much higher. Further, new lending becomes difficult, as the economy makes everyone unwilling or unable to take on significant risk. Compounding these issues are the lowered interest rates, which make banking less profitable, although this is helpful for asset prices that help repair bank balance sheets.

Short Term Versus Long Term Investing

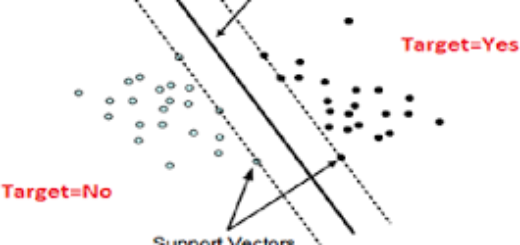

The perspective of a value investor can be better understood through Benjamin Graham’s description of the stock market as a voting machine in the short term but a weighing machine in the long term. The meaning of this metaphor is in the short term, stock prices are determined by the emotions and opinions of market participants. However, in the long term, the price is driven by the actual performance of the business.

Graham is considered the father of value investing, emphasizing a focus on a stock’s long-term fundamentals. Since bank stocks are perhaps the most susceptible to these emotional short-term forces given the leverage and nature of the business, it is natural that value investors are drawn to this sector.

Quantitatively, value investors seek out stocks with low price-earnings ratios. Sometimes, if a company is really struggling, it may be losing money, so this metric is less useful than sales or gross margins. Another measure of value is the price-to-book ratio. The book value of the company reflects the accounting value of the company after accounting for all types of liabilities.

please take into your account while investing in stocks

1. Competition:

The increased competition among banks is one of the key reason which will put pressure on the bottom line of the banking stocks. Recently RBI issued 2 full banking licenses, 11 payment bank licenses, and 10 small banking licenses. At the end of the day, all these new banks will eat into the same pie. In the recent SBI conclave, the SBI chairman cautioned about increased competition among banks. Indirectly she said that it will impact the performance of existing banks. The reason for new licenses is predominantly financial inclusion. On the other hand, the global experience tells a different story. Two Sectors i.e. Auto and Banking need a scale of operation to succeed. This is the reason that none of the Indian Banks features in World’s Largest Banks. Increased competition will limit the performance of the banking stocks. Therefore, it is one of the key reason which is keeping me away from banking stocks.

2. NPA’s:

NPA’s is another key concern. Through the magic of accounting, banks report NPA’s under different heads thus report lower number. According to recent reports from global agencies, only 3 banks are performing well on NPA front. These 3 banking stocks are Indusind Bank, HDFC Bank, and Axis Bank. Though NPA disclosure is opaque and can be as high as 2 digits. Recently, ICICI Bank Stock was beaten due to exposure in JP Group of companies. Currently, none of the banks is disclosing their exposure in Amtek Auto. Just assume the impact of Amtek Auto exposure on Banking Stocks. All said and done, NPA is a serious threat to the performance of banking stocks.

3. Base Rate Calculation:

Recently RBI circulated paper on a formula to calculate the Base Rate. It will have a serious impact on the NIM (Net Interest Margin) of banks. The banks which will suffer most are banks with higher loan book linked to base rate. As per estimates, approx 65%-75% loan book of ICICI Bank and Axis Bank are linked to Base Rate. Least impacted will be HDFC Bank as the bank does not process Home Loan. HDFC Home Loan is through HDFC Ltd. Another least impacted banking stocks will be Indusind bank and Yes Bank. It is not feasible to calculate the exact impact of new base rate calculation but will definitely impact margins of banking stocks.

4. Social Banking Accounts:

Zero Balance accounts will be another major burden on banks balance sheet. It will in turn put pressure on the performance of banking stocks. it’s a big challenge to make accounts opened under Pradhan Mantri Jan Dhan Yojana operative. Though i am completely in favor of financial inclusion as it is a must for the growth of the country. On the other hand before investing in banking stocks, it will be a major deterrent for me as an investor. Stock investment/performance is a question of my survival therefore banking stocks will not be on my radar.